CA Senate Hearing on West-Wide Governance Pathways Initiative

Here, VX News excerpts the March 12, 2025, California Senate Energy, Utilities, and Communications Committee hearing on Regional Expansion of Wholesale Electricity Markets. Including Committee Chair CA Senator Josh Becker, and testimony from California PUC President Alice Reynolds, California ISO President Elliot Mainzer, and California Energy Commission Vice Chair Siva Gunda, providing an overview of the West-Wide Governance Pathways Initiative, which aims to establish a collaborative regional governance structure to optimize electricity markets, promote energy affordability, and enhance resilience while respecting state authority over procurement and environmental policies.

“We can co-design, co-own, and co-implement necessary market design elements. That core value proposition, including the impetus behind this discussion, led to the development of a letter that marked the formal origins of the Pathways Initiative.”

Senator Josh Becker

Senate Committee on Energy, Utilities, and Communications come to order. Good afternoon. Welcome to the committee's second meeting of the 2025–26 legislative session. Excited for today's discussion on a topic that's been discussed extensively over the last ten years before I got to the legislature. I remember reading op-eds about it, trying to pay attention. I know Jerry Brown was a huge advocate of this. There were bills then over in the Assembly, but none have made it over to the Senate in my time here that we've been able to have a discussion.

I think given the importance and complexity of this topic, we decided that it would be important to have an overview of the Pathways Initiative. In the past, proposals to expand the grid were opposed by a variety of stakeholders, including labor unions, local publicly owned utilities, and environmental groups. Many have coalesced around a targeted approach they believe achieves desired benefits while protecting key California policies. This is meant to be a deeper overview of this initiative than we normally get a chance to do. What is it? How would it work? How is it different from past proposals? Then, hearing about any benefits and concerns as well. We've invited regulators, members of the Pathways Working Group, experts, public power utilities, as well as critics of past versions of Western grid expansion. During today's hearing, we'll discuss 3 key issues.

1. Does this initiative make serving California's energy needs more affordable?

2. Will the initiative help towards our emission reduction goals and other climate policies in California and across the West?

3. In a world where we are already exposed to FERC because our current market rules are subject to and approved by FERC, what is our current exposure, and does Pathways affect that? What exactly are the protections available to the state in the Pathways Initiative? How would those work?

Then, we'll have a dialogue on whether those are sufficient. I do want to address some concerns about coal use in a Western grid world, so we will discuss various protections we already have, including long-term contracts that don't allow coal. But it's fitting to note that we're having this overview on a day that The Wall Street Journal just reported today, that last year, for the first time, solar energy and wind generated more electricity across the whole U.S. than coal. Coal is about 15% of the total of the U.S. grid now. Solar grew 27% last year alone. Solar and wind accounted for 84% of new generation and 94% of all generation. The new generation across the country was clean.

Today, the Pathways Initiative includes perspectives from diverse voices in the energy landscape, hoping we can have a real, thorough conversation and vet the concerns. We are all cognizant that legislation is pending, but we are organizing this overview of the Pathways Initiative, which is not intended to debate the pending legislation itself. We ask comments to be limited to the initiative and not the bill proposal, which will be heard on a different day.

Joint Presentation (Alice Reynolds)

Good afternoon. I'm pleased to be here today with my colleagues from CAISO and the California Energy Commission (CEC) to discuss the West-wide Governance Pathways Initiative process. As you recall, we provided this committee with a general overview of the Pathways Initiative at a hearing last August, and today we will provide you with a status update for context.

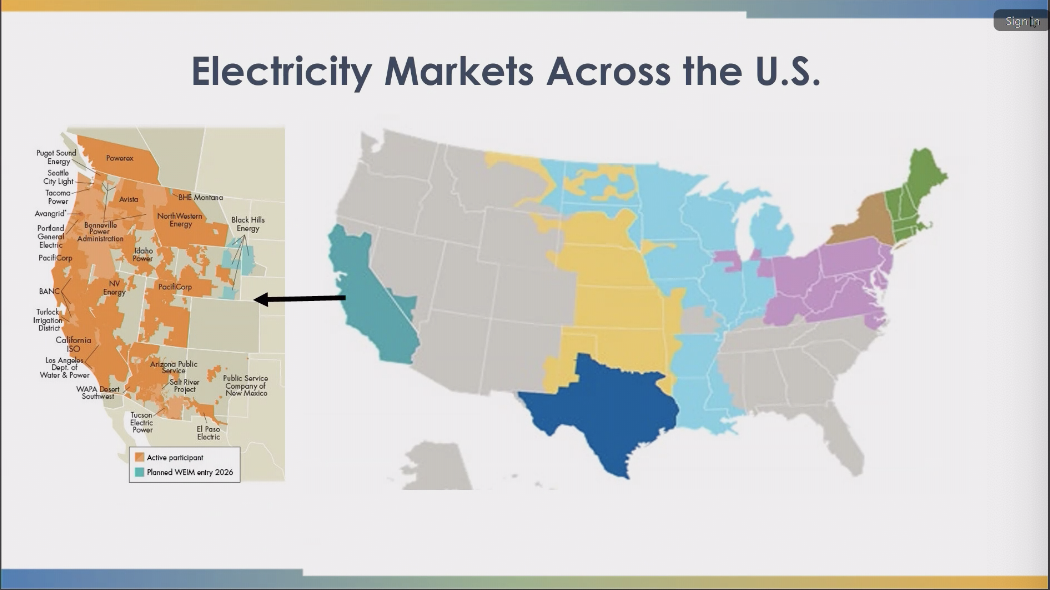

I want to start by zooming out with a depiction of the wholesale electricity markets across the country today. Several types of electricity markets in the United States allow electricity to be sold and purchased across a large footprint under the coordinated operation of an independent organization to improve the efficient dispatch of electricity generation for reliability and cost reduction.

As you can see on the map, several wholesale electricity markets have footprints across multiple states. Here is PJM, the ISO in New York, ISO New England markets in the East, MISO in the Midwest, SPP in the central region, and ERCOT in Texas. Some of these cover multiple states, and like all interstate commerce under the Commerce Clause of the Constitution, electricity markets are subject to federal regulation. In the case of electricity, the federal regulator is the Federal Energy Regulatory Commission (FERC).

CAISO’s markets and transmission operations, which are shown in teal across California, are currently subject to FERC jurisdiction in the current CAISO footprint, also called the balancing authority area, which appears in teal or blue-green on the map of the California region. However, what the map does not show is that the western half of the entire U.S. is a single interconnected electricity grid known as the Western Interconnection. CAISO oversees one portion of that grid, and California trades electricity with other states every day. In general, California is a net importer, meaning it imports more electricity from other states than it exports. The left portion of the slide, if you follow the arrow, shows the larger real-time market that already exists in the West. You’ll hear more about this from President Mainzer, but I wanted to introduce the Western Energy Imbalance Market (WEIM), a real-time market that has been operating for over ten years. The map to the left shows the current footprint of the WEIM. CAISO is also in the process of establishing an expanded day-ahead market called EDAM, which will allow broader participation in CAISO’s current day-ahead market. You’ll also be hearing a little more about that.

The Pathways Initiative aims to establish a collaborative regional governance structure for WEIM and EDAM, and we’ll be discussing that initiative in more detail. For additional context, this slide shows the current landscape of energy supply planning and services in California and the primary roles of various actors.

Next to each entity, we’ve listed some of the main functions concerning overall energy supply planning:

CARB sets the requirements for economy-wide greenhouse gas (GHG) reduction, including the electricity sector.

CEC handles load forecasting to prepare for demand increases and oversees the Renewables Portfolio Standard.

The CPUC is responsible for The Pathways Initiative aims to establish a collaborative regional governance structure for WEIM and EDAM, and we’ll be discussing that initiative in more detail. For additional context, this slide shows the current landscape of energy supply planning and services in California and the primary roles of various actors.

supply and reliability planning to ensure California is prepared for future conditions and can cost-effectively plan for clean energy supply while also playing a role in RPS oversight.CAISO is responsible not only for market operations but also for transmission planning and operation.

At the bottom row, various entities—including Community Choice Aggregators, publicly owned utilities, and investor-owned utilities—are responsible for serving communities across the state, each of these entities must provide a reliable electricity supply while meeting increasingly stringent clean energy requirements.

What I want to emphasize with this slide is that we are not discussing any reduction in planning or oversight functions today. We are only discussing the first bullet on the CAISO row—market operations. With the Pathways proposal, California would retain its autonomy in all aspects of energy policy, regulation, and system planning. CAISO would also maintain control over transmission, use, and dispatch of generation within its footprint. It would retain its role as a market operator, and the CAISO balancing area footprint would remain unchanged concerning balancing authority functions. With that, I will now turn it over to President Mainzer at CAISO.

Joint Presentation (Elliot Mainzer)

Thank you, President Reynolds. It is an absolute pleasure to be here with you today. I’m going to build on President Reynolds’ introduction and provide a bit more information and detail about CAISO’s functional structure, our two major responsibilities—balancing authority and market operations—our regulatory oversight, and our existing governance structure.

First and foremost, our principal responsibility, going back to our origins in the 1990s, is to operate the balancing authority within California, which covers about 80% of the state. Our central responsibility in this role is to maintain the real-time balance of supply and demand and to ensure the reliability of the transmission system. This is an essential function for us.

We are also responsible for managing the interconnection of new resources to the grid through the interconnection queueing process–another key responsibility. Additionally, we oversee the transmission planning process in collaboration with the CPUC and the CEC for California. We work closely with the CPUC and CEC to implement SB 100 and onboard the new clean energy resources necessary to keep the state on track with its goals. We’ve had some success in this area—just in the last several years, we’ve brought online approximately 25,000 megawatts of new generation, including the nation’s largest fleet of four-hour lithium-ion batteries. This onboarding of new resources is a key part of the equation for us, along with our general responsibility to support the state in achieving reliable and affordable electricity operations.

In terms of regulatory oversight, as President Reynolds mentioned, we are regulated by the Federal Energy Regulatory Commission (FERC), as the management of interstate transmission lines falls under federal jurisdiction. We also comply with the North American Electric Reliability Corporation’s (NERC) reliability rules, similar to other utilities. Additionally, we are part of the broader Western Interconnection and the Western Electricity Coordinating Council (WECC). We are currently governed by a board of five independent governors who oversee our operations.

Finally, I wanted to talk about our existing board structure. The CAISO Board of Governors consists of five individuals, with Chair Bornstein currently serving as the chair. They have critical responsibilities, particularly concerning our balancing authority operations. They review and approve the annual CAISO budget, oversee our board meetings, and engage with stakeholders to ensure that the policies we advance to the Federal Energy Regulatory Commission for approval are balanced and reflect diverse stakeholder interests. They also approve the annual transmission plan that we submit every couple of years.

These governors are appointed by the Governor of California, confirmed by the California Senate, and are independent of any individual market participant. Even here in California, for our CAISO board, that independence is a fundamental concept. Now that we've discussed our core responsibilities as a balancing authority operator, I’d like to turn to our role as an operator of regional electricity markets.

Over the last 10 years, the CAISO has extended our real-time market across a significant fraction of the western United States through what's known as the Western Energy Imbalance Market. This market is a real-time market—it operates in the next 5, 10, or 15 minutes. It allows the optimization of resources by taking advantage of the large transmission lines that extend from California up into the Pacific Northwest and out into the Intermountain West and the Desert Southwest, as well as the resource diversity across that footprint. It now includes 21 participating utilities outside of California, spanning 10 diverse Western states. Over the last decade, by leveraging that transmission activity and resource diversity, the WEIM has generated nearly $7 billion in gross financial benefits for electricity customers.

These financial benefits are significant, but I want to emphasize that, perhaps even more importantly, the WEIM has become a crucial tool in maintaining reliability in California. As you all know, the past several years have brought extreme weather events, including record-breaking heat waves and unprecedented spikes in electricity demand. In addition to California’s strong resource adequacy framework, the WEIM has played a key role in moving power across a broad footprint to where it is most needed, supporting reliability in both California and other states during highly challenging conditions.

Building on the WEIM’s foundation, we have spent the past few years developing the Extended Day-Ahead Market (EDAM). This market expands upon the WEIM’s principles, extending them into the day-ahead timeframe, where there are even greater opportunities for optimizing system efficiency, enhancing reliability, and reducing costs. After extensive stakeholder engagement, the EDAM tariff was approved by the Federal Energy Regulatory Commission last year, and we are now preparing to implement EDAM next spring. I also want to highlight that both the WEIM and EDAM are voluntary markets. Under long-standing legal principles, FERC cannot require entities to participate in these markets, nor can it prevent them from withdrawing if they choose to do so. This voluntary framework has been fundamental to the success and expansion of these markets.

Finally, since the inception of the WEIM, it has been crucial for participating utilities and regulators outside of California to have a voice in market governance. To ensure this, we established the Western Energy Imbalance Market Governing Body—a five-member independent entity with delegated authority over market rules specific to WEIM operations. They are selected by regional stakeholders, maintain financial independence from markets, and work collaboratively with the CAISO Board of Governors. This governance model has fostered effective shared decision-making.

However, with the development of EDAM—a market that entails a deeper level of resource commitment—questions about governance have naturally evolved. As we move forward with the Pathways Initiative, our objective remains clear: to preserve CAISO’s core responsibilities over California’s balancing authority functions while establishing a governance structure that supports regional market expansion. The balancing authority responsibilities—real-time reliability management, interconnection queue administration, transmission planning oversight, and SB 100 coordination with the CPUC and CEC—will remain under CAISO’s jurisdiction. Meanwhile, the governance framework for WEIM and EDAM will continue to evolve to reflect the broader regional interests of participating entities.

With that context, I will now hand it over to Vice Chair Gunda to discuss the Pathways Initiative in greater detail.

Joint Presentation (Siva Gunda)

Thank you for this opportunity to talk through some of the core aspects of the Pathways Initiative. I'm going to take the context that was set by President Reynolds and President Mainzer and dig into the origins of the Pathways Initiative with some of the proposals that came out of the Pathways Initiative. To uplift what President Reynolds just mentioned, there are two primary functions of CAISO.

There is a whole slew of work under the balancing area function, including transmission planning and balancing the grid. Then you have the second function, the West-wide services that CAISO today has, including administering the EIM and potentially the EDAM expansion. As we work through this and look at the last 10 years of work across the West, there is a continued recognition across a broad group of consumers and stakeholders that moving the markets from real-time to day-ahead would unlock opportunities in terms of reliability and affordability. Again, to just enhance that today in the EIM, you are looking at the supply-demand balance, and you're trying to optimize that in real-time versus what EDAM does, which allows you to think about what the supply and demand looks like the next day, and optimizing the day-ahead timeframe unlocks a lot of opportunities. So that has been recognized as one of the core opportunities in the rest of the West.

The second point is, as we continue to evolve the markets and recognize the value that the markets can provide in terms of reliability and affordability, capturing a large footprint of market space that has diversity of resources, both in terms of their technology attributes and geographic diversity, would unlock maximum benefits. Those are the two value propositions that have been broadly recognized, both in California and the rest of the West. As we started discussing the continued evolution of those markets and unlocking the value of the markets, what has come up in discussions with Western regulators—several regulators in the West in discussions that we have under existing forums that both President Reynolds and I, along with other commissioners, are part of—is a need to think about a new framework that can maximize the benefits of an extended day-ahead market. This framework is rooted in common values of the West, and California has the opportunity to be on a level playing field while ensuring we continue to have autonomy over our balancing area functions, while also having a conversation around the opportunity for governance reform to maximize the market footprint.

That’s really what the thrust of the discussion was across the West, and it ultimately led to the origins of the Pathways Initiative. Some of the key values are really around affordability and reliability. When you talk to regulators across the West, whether it's regulators from Idaho, Montana, Wyoming, or Oregon, every single regulator cares about affordability and reliability, and it's a common theme. There's also a common theme across the West on ensuring that consumer benefits are maximized and equitably distributed. Finally, as President Reynolds mentioned, the autonomy of state policies and ensuring that our climate priorities are grounded in our planning, as with the rest of the Western states in maintaining that autonomy.

Some discussions—though not a part of today’s discussion—have also addressed the integration of market services. Different states prefer different options, and one of the core takeaways was the need for optionality. Any group of states should have opportunities to improve their market services in a way that best suits them.

Lastly, something we value deeply in California is equitable representation—that every state feels like they are a part of the conversation. We can co-design, co-own, and co-implement necessary market design elements. That core value proposition, including the impetus behind this discussion, led to the development of a letter that marked the formal origins of the Pathways Initiative.

In July 2023, regulators from five states—California, Washington, Oregon, New Mexico, and Arizona, including both President Reynolds and me—issued an open letter advocating for a more action-oriented approach to realizing the potential of an expanded market. This effort led to the formation of a launch committee, composed of voluntary stakeholders from across the West. Their objective was to develop proposals that aligned with shared values and maximized benefits for all participants.

Both President Reynolds and I, along with several Western commissioners, are actively engaged in launch committee meetings, providing guidance on regional needs and offering feedback on proposed market structures. Over the past year and a half, this group has developed two key proposals.

The first proposal is on a greater authority, thinking through the best governance structure around market functions. I want to reiterate a balancing area function and the market function. How do we have the market function be co-equal, or have upliftment in primary authority?

Let me take a minute and walk through what that means. Currently, there are two boards. You have the governing body of CAISO and the governing body of the markets. This particular step one is around having the governance be co-equal between those two entities. What came together was, how do we give the WEIM governing body the primary authority over market functions?

I still want to make sure that I kind of re-emphasize that the balancing area functions continue to be under the CAISO board, but it pertains to the market functions, there's the primary authority for the board to think about how best to represent the Western interests, and that has been put in front of the CAISO governing body and has been adopted since.

Step two is thinking about creating the next step, which is the independent regional organization with sole authority over market design and decisions. This is an important step forward, and where we are looking at a new regional entity that is formed that allows for the market design functions to be under that regional organization, but still, CAISO retains both the balancing authority function, but also the implementation of the markets. That's an important element of the design.

I wanted to close with a couple of pieces. As step one and step two moved forward, one of the things that the state agencies wanted to do—both CPUC and CEC—is look at, as the designs are coming together, what the benefits of those extended regional markets or expanded regional markets could look like? As you see here, I put it at a high level and welcome discussions based on the modeling we've done.

I want to recognize it's preliminary modeling. It's phase one. We are going to continue to improve the modeling and the assumptions. We looked at going from where we are in terms of EDAM commitments, and some of the California balancing authorities have already committed to EDAM to the largest footprint of the West. If you look at that footprint, what is the maximal benefit we can get?

That's about $790 million in the preliminary analysis, and also the renewable curtailments overall reduce by about 10%--so maximizing the opportunity of the build rate. GHG emissions and local pollution reduce in California. And for reliability, given that we are working with a large amount of resources seamlessly, it allows for more cushion of resources available to the market for reliability events. With that, I'll pass it back to President Reynolds.

Joint Presentation (Alice Reynolds)

Just to wrap up here, I wanted to emphasize that I'm here with Vice Chair Gunda as state regulators to really make sure. From the beginning, we have focused on an interest in making sure that consumers and grid reliability are the North Stars of the evolution of pathways. When you think about what a market does, what markets electricity markets do is optimize the efficient dispatch of resources, and this reduces costs, and it increases reliability. This is especially true when you think about renewable resources. It's a benefit.

There's a value to having a market that is bigger than any one weather event. And so when we have a large market, we're able to operate reliably, even if the wind isn't blowing in certain areas or the sun isn't shining in certain areas. You get that efficiency, which helps consumers, it helps control costs, and it helps with reliability.

With that in mind, as Pathways has evolved, we've focused on making sure that there are public interest components–-two of those I have at the top of this last slide. One is that the formation documents of the regional organization will fundamentally have a purpose to serve customer interests, meaning reducing costs and increasing reliability. The formation documents of the new entity, also through the Pathways Initiative, are planned to have a provision to respect the authority of states to set their procurement environmental reliability.

Other public interest policies of the Pathways proposal also include specific proposals to add additional protections for public interest. I have some of those listed in the bottom portion of this slide, including the first one, which is the corporate documents. It’s important to have that public interest and purpose embedded.

Next is expanding the body of state regulators. This is an advisory body that currently acts to advise the WEIM using transparent decision-making processes, involving the idea that public meetings have to be held and comments will be received in public. Then, creating a new independent consumer advocate organization and a new office of public participation as part of the effort. I wanted to close with that, and we're happy to take any questions.